What’s The Bright Spot for Investors in Global Cooling? Part II

By – Published in on April 7, 2014

If history is any guide, the world will continue its current 15 year cooling trend for another 20 years potentially. In fact, there is a good chance the earth is about to go into one of its coolest periods in the last 250 years.

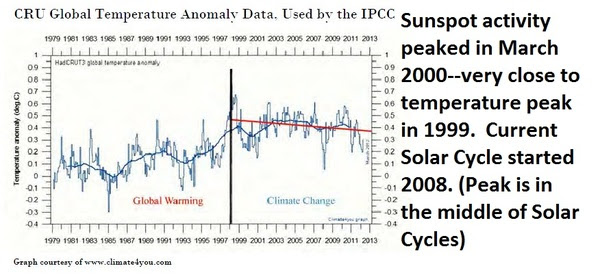

In a new report by Boston-based Unit Economics, they explain how sunspot activity is the key to understanding earth’s temperature. Sunspots have very predictable and accurate cycles. The last sunspot peak was March 2000 in the sunspot cycle that ended in 2008.

What does near term global cooling mean for energy investors? Among other potential trades, CEO Nathan Weiss suggests grain crops for the next two years should provide bumper harvests, keeping supplies high and prices low—which is great news for ethanol stocks. (Yes I am long ethanol ;-))Unit Economics says the best way to assess solar activity is through sunspot activity. (I’m going to get a little technical here so you may have to re-read a couple paragraphs.)The sun is a ball of circulating plasma. Sometimes the circulations become so energetic that plasma escapes, ejecting out into space, where it cools rapidly and is pulled back by the sun’s gravitational pull.From earth, the cooler returning plasma appears darker than the rest of the sun, creating a sunspot. And the more active the sun, the more frequent its spots.

A more active sun also has another important characteristic: a stronger magnetic field.

Grade 9 science shows that a magnetic field forms when electricity runs through the coils of an electric motor. Well, in the same way, the circulation of charged plasma creates a magnetic field around the sun. When those circulations ramp up, the magnetic field strengthens.

A stronger magnetic field means fewer particles from outside our solar system (cosmic rays) make it to earth. However, that actually makes for a warmer world.

The reason is clouds. Cosmic ray particles actually seed cloud formation. When the sun is not very active, lots of particles penetrate its relatively weak magnetic field and make it to earth. Those particles seed lots of clouds, creating a cloud layer that reflects the barrage of particles back into space.

Of the solar energy that reaches (and warms) our atmosphere, about 30% are reflected right back into space, largely thanks to clouds. Thus the cloudier it is, the colder our world.

When the sun is active (more sunspots) and its magnetic field strong, fewer cosmic ray particles means less cloud cover and a warmer planet.

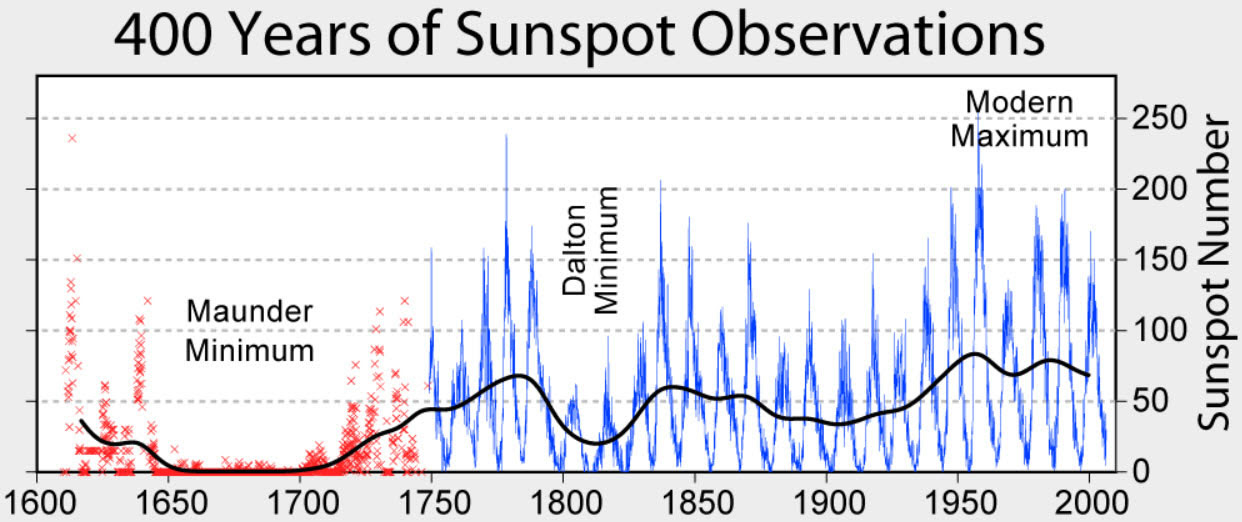

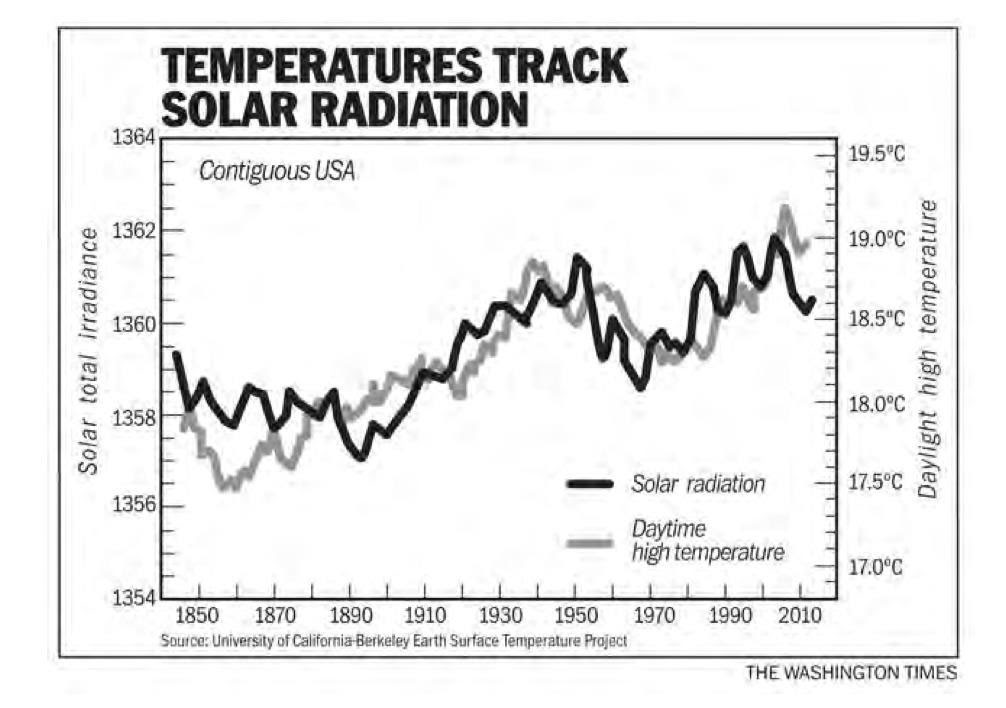

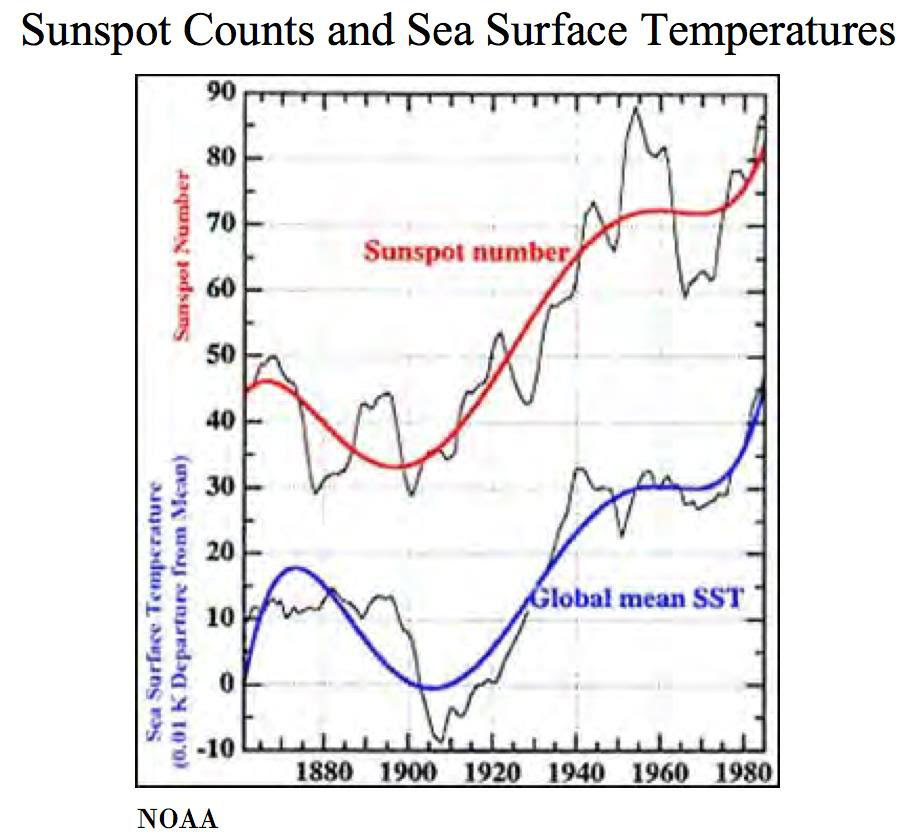

That’s the theory – and the data backs it up. Look at these three charts:

It seems clear solar activity plays a major role in global temperatures.But the best news is yet to come: solar activity follows surprisingly stable – and thus predictable – cycles. The shortest solar cycle averages 11 years in length. Other concurrent cycles have durations of 22, 53, 88, 106, 213, and 420 years.Cycles also vary in intensity. Shorter cycles are more intense. That’s because total solar electromagnetic output is pretty consistent from one cycle to the next, and so shorter cycles have higher peaks.Combining these cycles and their intensities, scientists created a model of solar activity that fits historic sunspot observations quite well – and tells us what to expect from the sun in the future.

The bottom line is that the current lull in solar activity is highly likely to persist for another 19 years. Yup, lots of cosmic particles will create lots of clouds and keep the earth cool for the next two decades.

Moreover, we are going through one of the quietest periods of solar activity in known history – and it may well herald another Dalton Minimum—the sunspot low of the last 1000 years from 1650-1850 that is the reason we have all the paintings of skating on the River Thames in London England.

Remember that long solar cycles are much less intense than short ones. Scientists time cycles from trough to trough, so a new cycle starts when solar activity begins increasing after years of decline. The duration of the decline – the time from peak to trough – gives good hints as to the nature of the next cycle.

Solar cycles that don’t get underway until more than 92 months after the previous peak reach less than half the intensity of those that kick off before 92 months have passed. Delayed cycles are also much longer. The current cycle, dubbed Solar Cycle 24, did not really get going until early 2010 – 126 months after the peak of Solar Cycle 23.

The weakest solar cycle of modern times was Cycle 5, which lasted from 1796 to 1830—that was the Dalton Minimum. Temperatures were a full 2 degrees lower than average and history books talk of summers that never arrived. Solar Cycle 5 started 123 months after the peak of Solar Cycle 4.

The sun is also very quiet these days. We are supposed to be in the midst of an upswing in solar activity but the best guess puts the peak of Solar Cycle 24 at between 33.75 and 40.5 sunspots per year (after accounting for our ever-increasing ability to detect sunspots today compared to two hundred years ago). Solar Cycle 5 peaked at 49.2 sunspots.

As NASA solar physicist David Hathaway puts it, describing the great plasma conveyor belt of the sun: “It’s off the bottom of the charts… We’ve never seen speeds so low.”

BOTTOM LINE–Sunspot activity is suggesting we are moving into a time of lower temperatures on Earth this solar cycle. (You can see the times of the sunspot cycles here: http://en.wikipedia.org/wiki/List_of_solar_cycles)

There are two intriguing investment implications from this sunspot theory. Grain production is obviously impacted by weather and climate. The world is now into Year 7 of the current sunspot cycle. In a statistical review of grain prices in the last few solar cycles, Unit Economics found that Year 4–2011–was the peak for grain prices. Corn was up 57% that year and wheat was up 21%.

But this year–2014–should be the top growing year for these crops; bumper harvests are to be expected, keeping agricultural commodity prices low. This should be continued good news for US ethanol producers–Green Plains Renewable Energy (GPRE-NASD), Pacific Ethanol (PEIX-NASD), and REX American Resources (REX-NYSE). They already have great stock charts.

(In the long run (five or so years out) – shorter growing seasons resulting from colder weather will send grain prices higher)

The second bit of data crunching Unit Economics did was much more macro-oriented. In simplistic terms, when temperatures

decline by 0.25 degrees Celsius in a year vs. the 5 year rolling trend, the stock market generally declines. And the opposite holds true: when temperatures increase by 0.25 degrees against the trend, market action is positive.

Wait, you say. All of this seems to make sense…but what about everything I’ve hear for the last 20 years about our warming planet?

Manmade climate change theories and solar activity can co-exist! Weak solar activity can overwhelm long-term trends and result in cooler weather for the next two decades, even if man is warming the Earth. You may change your mind about ‘Climate Change,’ however, when you read Part III.

The bottom line is that the current lull in solar activity is highly likely to persist for another 19 years. Yup, lots of cosmic particles will create lots of clouds and keep the earth cool for the next two decades.

Moreover, we are going through one of the quietest periods of solar activity in known history – and it may well herald another Dalton Minimum—the sunspot low of the last 1000 years from 1650-1850 that is the reason we have all the paintings of skating on the River Thames in London England.

Remember that long solar cycles are much less intense than short ones. Scientists time cycles from trough to trough, so a new cycle starts when solar activity begins increasing after years of decline. The duration of the decline – the time from peak to trough – gives good hints as to the nature of the next cycle.

Solar cycles that don’t get underway until more than 92 months after the previous peak reach less than half the intensity of those that kick off before 92 months have passed. Delayed cycles are also much longer. The current cycle, dubbed Solar Cycle 24, did not really get going until early 2010 – 126 months after the peak of Solar Cycle 23.

The weakest solar cycle of modern times was Cycle 5, which lasted from 1796 to 1830—that was the Dalton Minimum. Temperatures were a full 2 degrees lower than average and history books talk of summers that never arrived. Solar Cycle 5 started 123 months after the peak of Solar Cycle 4.

The sun is also very quiet these days. We are supposed to be in the midst of an upswing in solar activity but the best guess puts the peak of Solar Cycle 24 at between 33.75 and 40.5 sunspots per year (after accounting for our ever-increasing ability to detect sunspots today compared to two hundred years ago). Solar Cycle 5 peaked at 49.2 sunspots.

As NASA solar physicist David Hathaway puts it, describing the great plasma conveyor belt of the sun: “It’s off the bottom of the charts… We’ve never seen speeds so low.”

BOTTOM LINE–Sunspot activity is suggesting we are moving into a time of lower temperatures on Earth this solar cycle. (You can see the times of the sunspot cycles here: http://en.wikipedia.org/wiki/List_of_solar_cycles)

There are two intriguing investment implications from this sunspot theory. Grain production is obviously impacted by weather and climate. The world is now into Year 7 of the current sunspot cycle. In a statistical review of grain prices in the last few solar cycles, Unit Economics found that Year 4–2011–was the peak for grain prices. Corn was up 57% that year and wheat was up 21%.

But this year–2014–should be the top growing year for these crops; bumper harvests are to be expected, keeping agricultural commodity prices low. This should be continued good news for US ethanol producers–Green Plains Renewable Energy (GPRE-NASD), Pacific Ethanol (PEIX-NASD), and REX American Resources (REX-NYSE). They already have great stock charts.

(In the long run (five or so years out) – shorter growing seasons resulting from colder weather will send grain prices higher)

The second bit of data crunching Unit Economics did was much more macro-oriented. In simplistic terms, when temperatures

decline by 0.25 degrees Celsius in a year vs. the 5 year rolling trend, the stock market generally declines. And the opposite holds true: when temperatures increase by 0.25 degrees against the trend, market action is positive.

Wait, you say. All of this seems to make sense…but what about everything I’ve hear for the last 20 years about our warming planet?

Manmade climate change theories and solar activity can co-exist! Weak solar activity can overwhelm long-term trends and result in cooler weather for the next two decades, even if man is warming the Earth. You may change your mind about ‘Climate Change,’ however, when you read Part III.

Comments